Adjusted trial balance explanation, format, example

The accounting equation is balanced, asshown on the balance sheet, because total assets equal $29,965 asdo the total liabilities and stockholders’ equity. There are multiple financial statements that are prepared by the businesses at the end of a financial year. Still, they prepare an adjusted trial balance as a ready reference. Its purpose is to ensure that the total amount of Debit Balance in the general ledger is equal to the total amount of Credit Balance in the general ledger. The adjusted trial balance (as well as the unadjusted trial balance) must have the total amount of the debit balances equal to the total amount of credit balances.

5 Prepare Financial Statements Using the Adjusted Trial Balance

- This would happen if a company brokeeven, meaning the company did not make or lose any money.

- This net income figure is used to prepare the statement of retained earnings.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- The statement ofretained earnings is prepared before the balance sheet because theending retained earnings amount is a required element of thebalance sheet.

Double-entry accounting (or double-entry bookkeeping) tracks where your money comes from and where it’s going. Before accounting software, people had to do all of their accounting manually, using something called the accounting cycle. The adjusting entries for the first 11 months of the year 2015 have already been made. The adjusting entries in the example are for the accrual of $25,000 in salaries that were unpaid as of the end of July, as well as for $50,000 of earned but unbilled sales. Discover the best business bank accounts for sole proprietors in 2025, comparing top banks to help you find the perfect fit for your needs. Review the annual report of Stora Enso which is aninternational company that utilizes the illustrated format inpresenting its Balance Sheet, also called the Statement ofFinancial Position.

IFRS Connection

As the name suggests, it includes deductions with respect to the tax liabilities. Financial statements give a glimpse into the operations of a company, and investors, lenders, owners, and others rely on the accuracy of this information when making future investing, lending, and growth decisions. When one of these statements is inaccurate, the financial implications are great.

Trial Balance: Definition, How It Works, Purpose, and Requirements

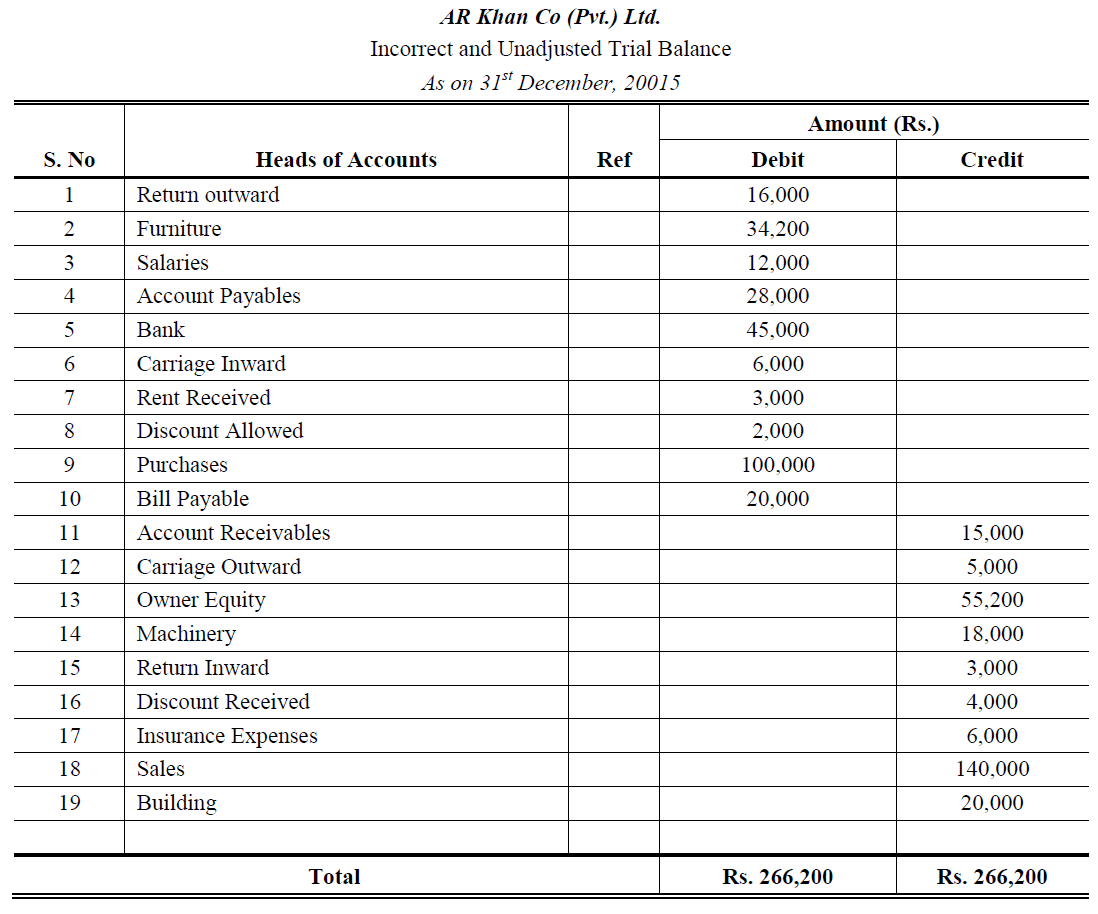

The adjusted trial balance for Bold City Consulting is presented in Figure 1. The next step of accounting cycle is the preparation of closing entries. The adjustments need to be made in the trial balance for the above details.

A trial balance only contains ending balances of your accounting accounts, while the general ledger has detailed transactions of the accounts. There’s also a chance it’ll fail to flag entries incorrectly coded to the wrong search for practice listings accounts, which can ultimately lead to inaccurate financial statements. Note that while a trial balance is helpful in the double-entry system as an initial check of account balances, it won’t catch every accounting error.

How to Prepare an Adjusted Trial Balance

The biggest goal of a trial balance is to find accounting errors and transposition errors like switching digits. By highlighting these mistakes, the trial balance acts as an accuracy check for a business, mitigating the risk of inaccuracies before you generate final financial statements. It’s one of the first lines of defense against accounting errors and a pivotal report within double-entry bookkeeping. Let’s look at what a trial balance is, how it works, the various types, and examples. Any difference indicates that there is accounting error in the journal entries or in the ledger or in the calculations.

The second method is simple and fast but is considered less systematic. This method is usually used by small companies where only a few adjusting entries are found at the end of the accounting period. In this method, the adjusting entries are directly incorporated into the unadjusted trial balance to convert it to an adjusted trial balance.

Note that only active accounts that will appear on the financial statements must to be listed on the trial balance. If an account has a zero balance, there is no need to list it on the trial balance. However, most businesses can streamline this cycle and skip tedious steps like posting transactions to the general ledger and creating a trial balance. Using accounting software like QuickBooks Online can do all these tasks for you behind the scenes.

When it comes to the adjustment made, the adjusted trial balance sheet is left with information that is relevant for a particular period as per the information that the business organization seeks. The adjustments made, however, are classified into different categories, which include – deferrals, accruals, missing transactions, and tax adjustments. The trial balance information for Printing Plus is shown previously.

Using a 10-column worksheet is an optional step companies may use in their accounting process. This is the second trial balance prepared in the accounting cycle. Its purpose is to test the equality between debits and credits after adjusting entries are made, i.e., after account balances have been updated.