What Are Adjusting Entries? Definition, Types, and Examples

It also helps users (lenders, employees and other stakeholders) to assess a business’s financial performance, financial position and ability to generate future Cash Flows. However, there is a need to formulate accounting transactions based on the accrual accounting convention. Recording such transactions in the books is known as making adjustments at the end of the trading period. For the sake of balancing the books, you record that money coming out of revenue.

The Process of Recording Adjustment Entries

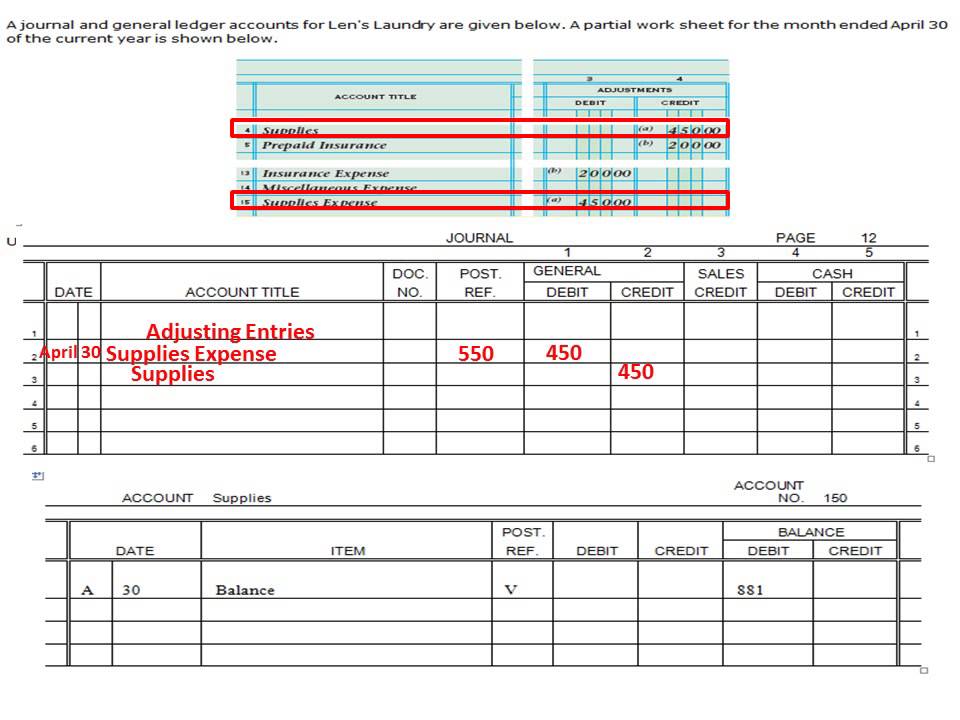

Here are the ledgers that relate to the purchase of supplies when the transaction above is posted. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. If the Final Accounts are prepared without considering these items, the trading results (i.e., gross profit and net profit) will be incorrect. In this situation, the accounts thus prepared will not serve any useful purpose. However, in practice, the Trial Balance does not provide true and complete financial information because some transactions must be adjusted to arrive at the true profit.

Adjusting Entry for Unearned Income

If a company has employees who have worked but have not yet been paid, an adjusting entry is made to record the amount of the unpaid wages as an expense and a liability. Adjustment entries are made at the end of an accounting period, which can impact the timing of when revenue and expenses are recorded. For example, if an adjustment entry is made to defer revenue to a future accounting period, this will delay the recognition of revenue until the future period. Adjustment entries are an essential aspect of accounting that ensures financial statements are accurate and follow accounting principles.

- We at Deskera offer an intuitive, easy-to-use accounting software you can access from any device with an internet connection.

- The same principles we discuss in the previous point apply to revenue too.

- The purpose of adjustment entries is to ensure that the financial statements accurately reflect the company’s financial position and performance.

- Here are the ledgers that relate to the purchase of prepaid insurance when the transaction above is posted.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Companies that take the time to properly record and adjust their accounts will be better equipped to make informed business decisions and meet their financial obligations.

Ask a Financial Professional Any Question

An adjusting entry is an entry made to assign the right amount of revenue and expenses to each accounting period. It updates previously recorded journal entries so that the financial statements at the end of the year are accurate and up-to-date. The adjusting entry for supplies updates the Supplies and Supplies Expense balances to reflect what you revenue recognition principle really have at the end of the month. Cash flow statements, while primarily focused on cash transactions, can also be indirectly influenced by adjusting entries. Accurate income and balance sheet figures, resulting from proper adjustments, ensure that the cash flow statement provides a comprehensive view of the company’s cash inflows and outflows.

To Ensure One Vote Per Person, Please Include the Following Info

Adjusting journal entries can also refer to financial reporting that corrects a mistake made previously in the accounting period. After preparing all necessary adjusting entries, they are either posted to the relevant ledger accounts or directly added to the unadjusted trial balance to convert it into an adjusted trial balance. Click on the next link below to understand how an adjusted trial balance is prepared. The same adjusting entry above will be made at the end of the month for 12 months to bring the Prepaid Taxes amount down by $100 each month. Here is an example of the Prepaid Taxes account balance at the end of October.

By December 31, one month of the insurance coverage and cost have been used up or expired. Hence the income statement for December should report just one month of insurance cost of $400 ($2,400 divided by 6 months) in the account Insurance Expense. The balance sheet dated December 31 should report the cost of five months of the insurance coverage that has not yet been used up.

Companies that take the time to properly record and adjust their accounts will be better equipped to make informed business decisions and meet their financial obligations. Adjustment entries are an important tool for businesses to ensure that their financial statements are accurate. These entries can impact a business’s cash flow, profitability, stock-based compensation, accounting periods, and fiscal year. Allowance for doubtful accounts is an estimate of the amount of accounts receivable that may not be collected.

Here are the Equipment, Accumulated Depreciation, and Depreciation Expense account ledgers AFTER the adjusting entry above has been posted. As a college student, you have likely been involved in making a prepayment for a service you will receive in the future. If you want to attend school after the semester is over, you have to prepay again for the next semester.

An income which has been earned but it has not been received yet during the accounting period. Incomes like rent, interest on investments, commission etc. are examples of accrued income. A related account is Insurance Expense, which appears on the income statement. The amount in the Insurance Expense account should report the amount of insurance expense expiring during the period indicated in the heading of the income statement.

Supplies are relatively inexpensive operating items used to run your business. When you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 12 different Certificates of Achievement. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Students should carefully note that every adjustment has at least two effects due to double entry. Before making adjustments, it is important to understand first what adjustments are and why they are needed.